The Times They Are A-Changin’

“There is nothing so stable as change.”

– Bob Dylan

The iconic singer-songwriter Bob Dylan reminds us of this simple truth that echoes through every aspect of life – from our personal journeys to the broader world around us. We’ve certainly observed this principle in action, with some notable shifts in market dynamics. This quarter, as we reflect on the constant flux of our experiences, let us consider how embracing inherent change can lead to greater resilience and clearer perspective, whether in our daily routines or our long-term goals.

Markets

Investors took a risk-off posture in the first quarter of the year, digesting the several fits and starts stemming from ever-changing proposals around trade, tariffs and immigration policies. Technology and consumer discretionary stocks sold off precipitously as investors shifted from a “buy-the-dip” mentality of years’ past to a “sell-the-rally” sentiment. The S&P 500 ended the quarter down -4.3% while the tech-heavy NASDAQ Composite fell -8.3%.

Overseas, we saw increased investor appetite for diversification from the US enabling western European stock markets to outperform the US markets, returning between +6% and +13% for the quarter. Bond market returns (as measured by the Bloomberg U.S. Aggregate Bond Index (AGG¹) were up +2.8% as treasury yields fell on declining investor sentiment and the expectation that the Fed will continue its rate cutting campaign over the course of this year. Central banks overseas continued cutting rates and easing monetary policy as inflation overseas has started to cool. Crude Oil (WTI Cushing Crude) was down -0.6% while Gold continued its rise, up +19.0% for the quarter.

Fundamentals and Valuations

A general theme this quarter has been the continued broadening out of market returns beyond the “Magnificent 7” mega-cap securities that have driven market returns over the last two years. Germany’s decision to significantly increase its defense spending in response to geopolitical tensions and shifts in international security dynamics have prompted a boost in investor confidence abroad, reflected in the rising DAX year-to-date.

The S&P 500 grew revenues at a rate of +5.2% year-over-year in the fourth quarter of 2024 while net income/EPS grew +13.5% for the year, reflecting companies’ focus on maintaining margins. The unemployment rate continues to remain low at 4.1%. While low unemployment levels typically contribute to higher consumer confidence, the broader concerns about tariffs and the Department of Government Efficiency (DOGE)’s cost-cutting initiatives in Washington have shown consumer sentiment drop to its lowest levels since August 2021. The impact of tariffs and DOGE actions on GDP growth remains a key question for investors.

Though the S&P 500 ended 2024 at a 26 times (x) price/earnings (P/E) ratio, slower earnings growth is anticipated, and the market has repriced forward expectations down (see Figure 1). Stocks on our individual buy list, which represent about 50% of the equity exposure for most client portfolios, have a forward P/E of about 16x earnings, about 26% cheaper than the S&P 500 Index.

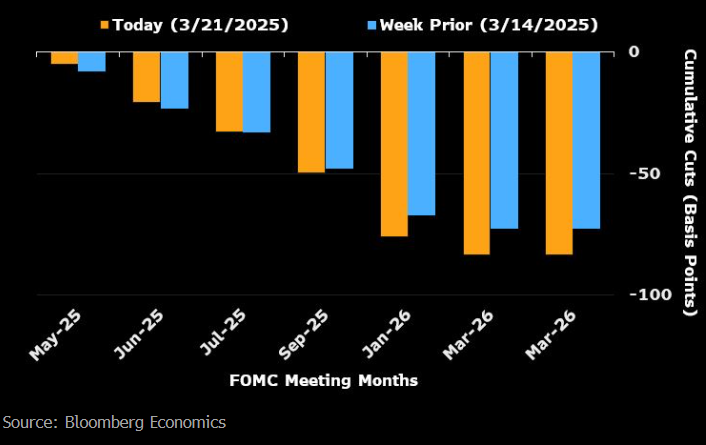

During March’s meeting, the Federal Reserve (FOMC) held rates steady but lowered its growth projections and raised its inflation concerns. The financial markets continue to price in two rate cuts by September, with some chance of a third cut in the fourth quarter and a steeper path of rate cuts in 2026 amid concern about downside growth risks (See Figure 2):

Figure One: S&P 500 Historical Valuations

Figure Two: Fed Funds Futures Price in Steeper Rate Cuts Next Year

Outlook and Investment Strategy

We expect continued noise and headlines around the political agenda of the Trump administration. Despite the unconventional approach DOGE is pursuing, U.S. Government spending cuts are desirable. All things equal, modestly tighter fiscal policy would cool the economy, allowing the Fed to bring down interest rates, spur demand, and boost employment.

With a lot of the on-again, off-again tariff talks that have centered around three specific trade partners (China, Canada, and Mexico), there is concern of supplier disruption and the near-term effects of companies “onshoring” their operations to minimize tariff implications.

Though time will tell what the long-term impacts of tariffs enacted on these three countries will be for global markets, we have conducted an internal supply chain analysis on the companies we own and the geographic exposure of their supply chain versus the broader US market. The individual companies we own have supplier facilities around the globe, but only 15% of supplier facilities are in China, Canada and Mexico, while 40% of supplier facilities are in the United States. When compared to the top 25 companies in the S&P 500 Index, 18% of this cohort’s supplier facilities are in China, Canada and Mexico while only 31% of supplier facilities are in the United States.

With broader policies pointing towards inflationary pressures, our base case assumption is that the Fed cuts 2-3 times in 2025 and largely remains data dependent until inflation comes back towards its target 2% goal. Any changes to labor, trade, or broader consumer sentiment may change the Fed’s appetite to cut, as the market was pricing in only one rate cut as early as mid-January of this year. As always, prudent diversification and risk management are paramount.

Closing Thoughts

As we are constantly barraged by headlines, magnified by markets reacting to the uncertainty surrounding proposed government policies, we often seek stability and security, building our lives around the idea that things remain the same. Life, like the financial markets, is a constant evolution. By acknowledging and accepting the stability of change, we equip ourselves with the resilience to navigate whatever comes our way.

Thank you for allowing us to be on your financial team and for referring us to those you care about the most.

Click here to download printable version of this newsletter.

[1] The “AGG” is a widely recognized benchmark for the US investment-grade bond market and includes government, corporate and securitized bonds.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.