Independent, Fee-Only Fiduciary Guidance

We accept no commissions, advice is always aligned with your best interests.

Invest with UsIntegrated, Goal-Based Wealth Planning

Investment, tax, estate, and philanthropy unite in one clear, purpose-driven strategy.

Plan with UsInstitutional Expertise, Boutique-Level Service

CFA and CFP®️ advisors oversee $500M+ portfolios while providing proactive, high-touch guidance.

Your Team

Partners in Your Success

At Regency Wealth Management, you won’t just have one financial advisor -- you’ll have a team of dedicated fiduciaries invested in your financial success. Our unique consultative team approach ensures that you benefit from our team members’ individual strengths and from the synergies that come from combining our areas of expertise. We are here to address your financial and investment planning needs and provide guidance every step of the way.

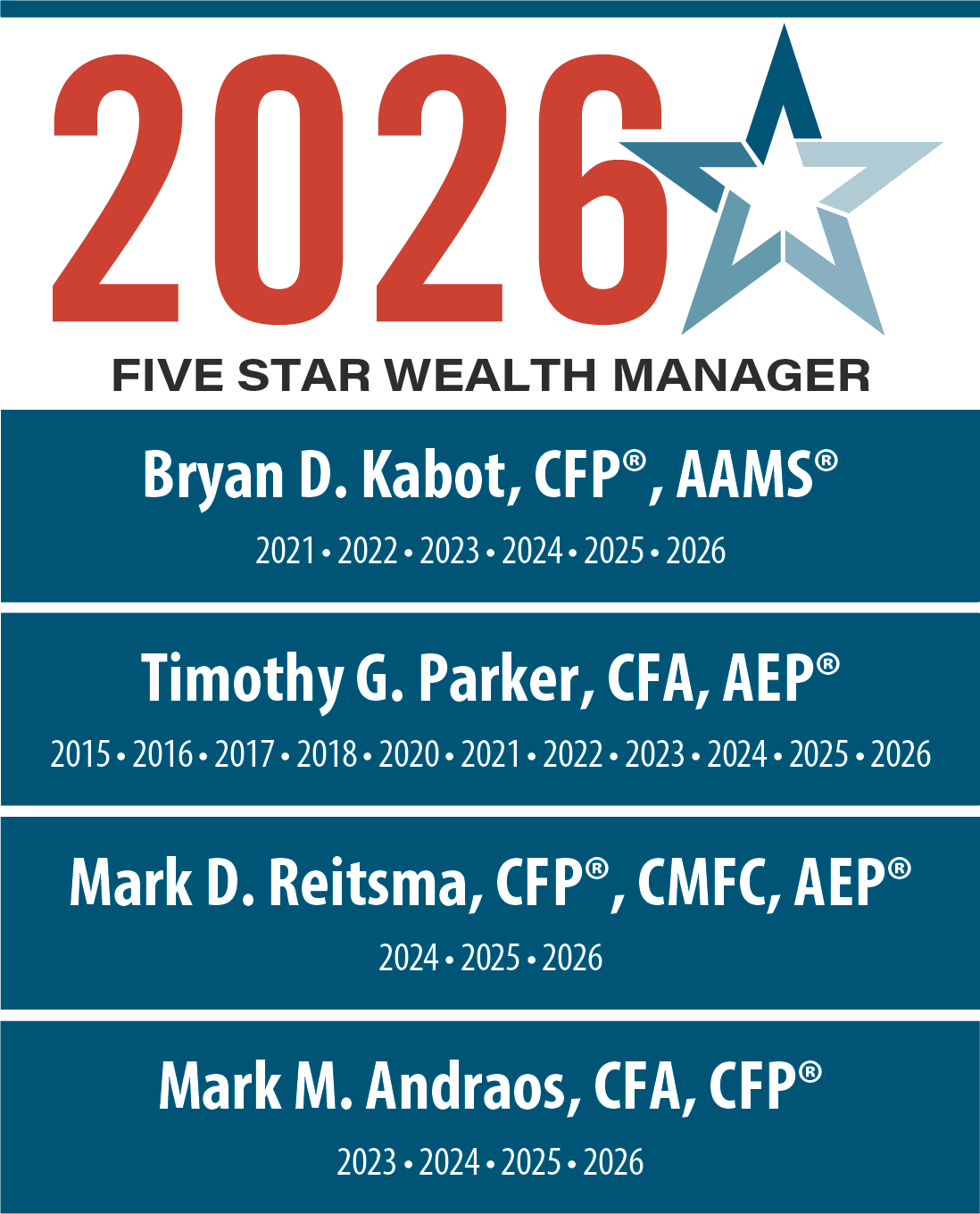

Our team of professionals have earned numerous certifications and awards in the financial services industry. Some of these individual recognitions include CFA, CFP®, AEP®, CMFC, and AAMS®.

Where Expertise Meets Simplicity

At Regency Wealth Management, we try to make complex financial lives simpler. From retirement planning to managing multi-generational or institutional portfolios, our team of fiduciary advisors brings clarity, discipline, and deep expertise to every relationship.

We lead with research, align every decision to your long-term goals, and handle the details, so you can focus on living generously and confidently.

Have Faith in your Financial Future

Whether you are looking for a personal wealth manager or you are an institutional investor, we are dedicated to developing and executing customized and effective financial planning and investment solutions designed to help you achieve your goals. We offer a wide range of financial services to individuals, families and institutions to give you the peace of mind you deserve:

Plan with Us

- Financial Planning

- Retirement Income Planning

- Estate Planning

Invest with Us

- Institutional Investing

- Asset Management

- Values-Based Investing

We are a Fee-Only firm

What’s the difference between fee-only and fee-based compensation? As a fee-only wealth management firm, we receive payment for our advisory services only in the form of fees paid by our clients. In contrast, fee-based firms are paid by clients for advisory services and may also receive commissions from third-parties to recommend certain financial products & securities.

At Regency, we take our fiduciary responsibilities and your trust very seriously.

Core Principles

The Regency team is comprised of financial management experts serving others excellently with integrity and transparency in a collaborative manner. As we assist clients in achieving and maintaining financial security, we seek to inspire them to live generously so that they can bless others.

Purpose

Regency Wealth Management is a creative and disciplined enterprise that seeks to produce an environment where clients and employees can flourish both economically and philanthropically, in a God honoring way.

Our Goals

- To build healthy and respectful relationships

- To be leaders in our communities

- To assist clients in meeting their financial objectives

- To provide meaningful careers to our employees

- To grow profitably without compromising service quality

Our Values

- Empathy

- Fiduciary

- Generosity

- Honesty

- Inspiration

- Integrity

- Joy

- Transparency